Coinbase’s head of investment research David Duong argues that developments in 2025—ranging from regulated ETF access and corporate crypto treasuries to the deeper integration of stablecoins and tokenized assets into payments and settlements—are beginning to reinforce one another. With global adoption holding steady near 10% and regulatory frameworks like the US GENIUS Act and Europe’s MiCA providing clearer guardrails, Duong believes crypto demand is maturing beyond short-term speculation.

Crypto Moves Closer to the Financial Mainstream

Momentum from crypto exchange-traded funds

In a year-end wrap-up that was shared on X, Duong argued that the structural shifts seen over the past year are beginning to reinforce one another, creating a compounding effect that could move crypto deeper into the core of the global financial system.

David Doung X post

Duong said 2025 was a turning point in how digital assets are accessed and used. Spot crypto ETFs

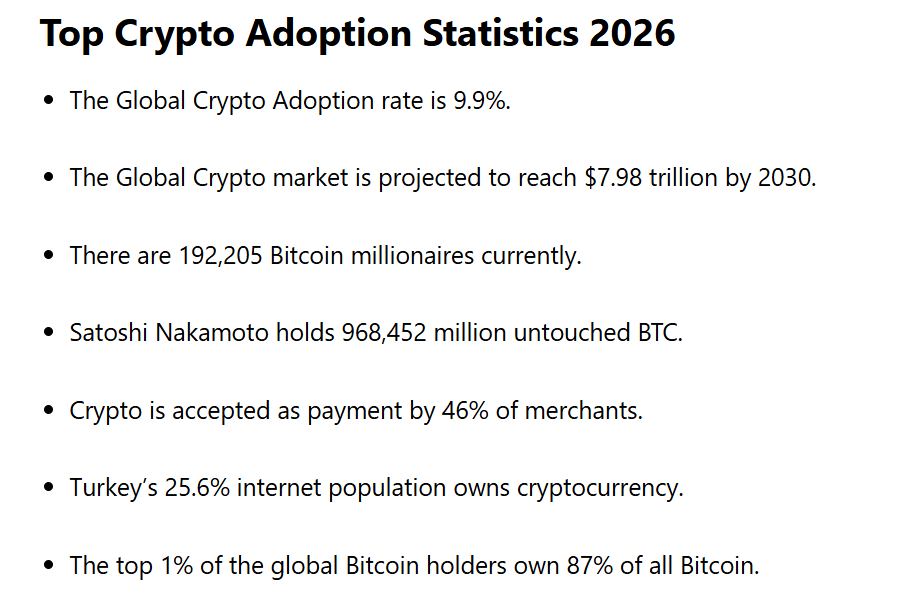

Despite volatile markets, Duong explained that global crypto adoption

Global crypto adoption statistics (Source: Demand Sage)

Regulation was another central theme in Duong’s outlook. He mentioned clearer global frameworks as a key driver behind crypto’s shift from a niche asset class toward an emerging layer of financial infrastructure. In the United States, policymakers focused on stablecoin oversight and market structure clarity through initiatives like the GENIUS Act

In Europe, regulators consolidated rules under the Markets in Crypto-Assets Regulation

He also believes that crypto demand is no longer driven by a single narrative. Instead, it is a mix of macroeconomic pressures, technological progress, and geopolitical considerations, with a growing share of long-term allocators shaping market behavior. Over time, Duong believes this shift could support more durable capital flows and reduce purely speculative churn.