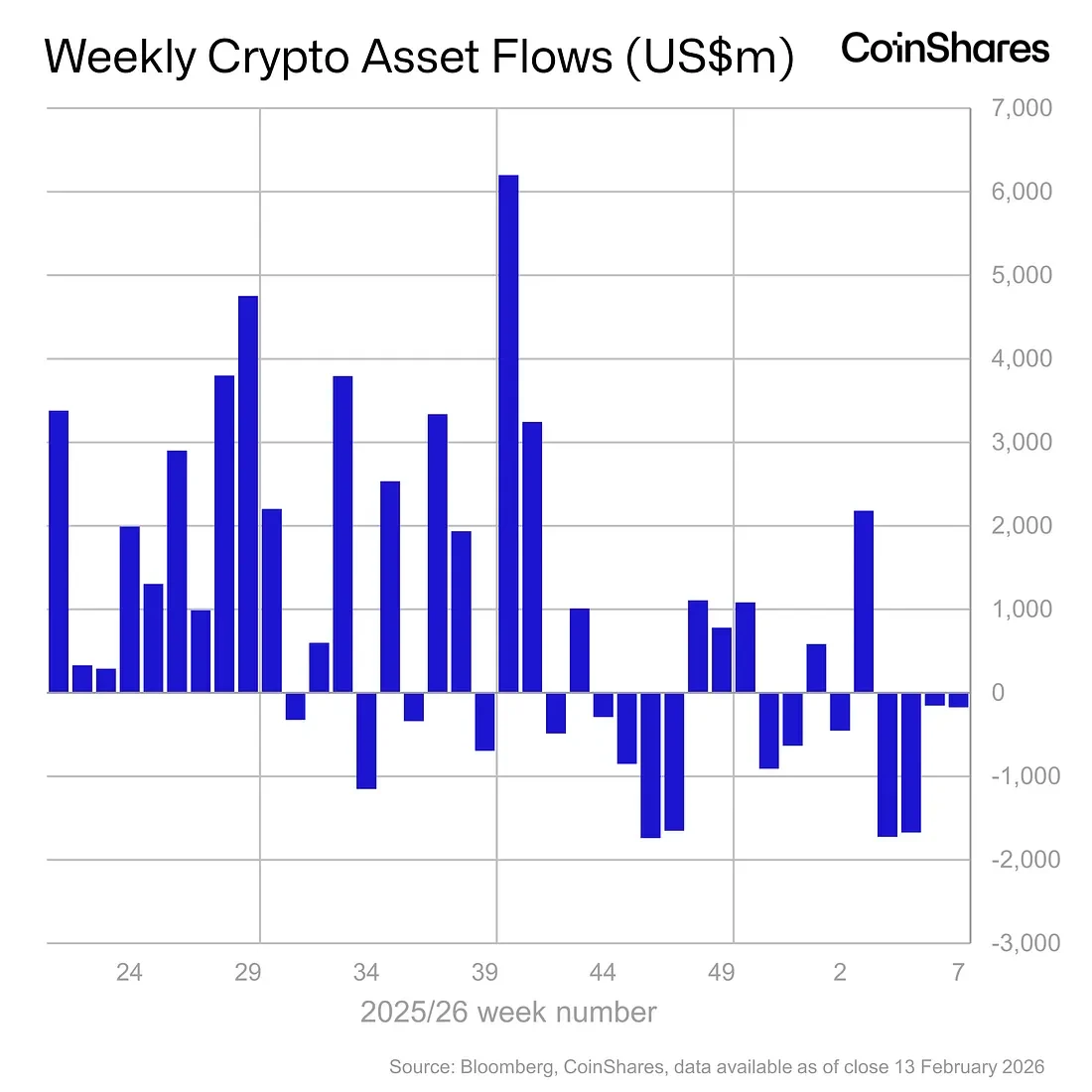

Crypto funds recorded a fourth consecutive week of investment outflows, totaling $173 million. Despite relatively small losses over the past two weeks, total outflows over the four-week period reached $3.8 billion.

Assets under management for crypto funds fell to $133 billion, the lowest level since April 2025. CoinShares head of research, James Butterfill, attributed the weekly outflows to negative market sentiment and ongoing price weakness.

Bitcoin started last week at $70,000 but briefly dipped to $65,000 on Thursday.

Bitcoin Leads Outflows While XRP and Solana See Inflows

Bitcoin funds were the primary drivers of negative sentiment, recording outflows of $133.3 million. Assets under management for Bitcoin products fell to $106 billion.

US spot Bitcoin ETFs showed an even steeper decline, with outflows approaching $360 million over the week, according to SoSoValue.

Ethereum funds followed the broader crypto trend with $85 million in outflows. However, US spot Ethereum ETFs demonstrated a modest $10 million inflow.

XRP and Solana bucked the trend, leading investment inflows with $33.4 million and $31 million, respectively.

Butterfill noted significant regional differences. US crypto investment products saw $403 million in outflows, while other regions collectively reported $230 million in inflows. Germany, Canada, and Switzerland led gains, adding $115 million, $46 million, and $37 million, respectively.

The outflows came as Standard Chartered analysts officially lowered their Bitcoin price forecast for 2026 from $150,000 to $100,000, also projecting a potential drop to $50,000 before recovery.

Institutional Concentration Drives Market Impact

The geographic distribution of capital flows reveals an interesting paradox: crypto assets, originally designed as decentralized, now show heavy institutional concentration in the US. The $403 million outflow from the US compared with $230 million inflows elsewhere highlights fragmentation in global institutional sentiment, a trend that often precedes structural market changes.

ETF liquidations add pressure to the spot market, as fund managers must sell underlying assets to cover investor redemptions, increasing volatility. The $106 billion concentrated in institutional Bitcoin products now acts as a powerful price-setting mechanism, something absent in the 2018 and 2022 bear cycles.