CoinShares argues that only a tiny fraction of coins are theoretically vulnerable and that the risk is largely academic. Research lead Christopher Bendiksen said most Bitcoin would take centuries to crack even under optimistic quantum scenarios, while core features like the 21 million supply cap and proof-of-work remain unaffected.

Bitcoin Quantum Fears Overblown

Digital asset manager CoinShares pushed back against the growing fears that quantum computing could soon pose a serious threat to the Bitcoin market, and argued that only a very small fraction of coins are actually exposed to any realistic quantum attack scenario. CoinShares’ comments were made due to renewed debate over whether advances in quantum hardware could undermine Bitcoin’s cryptographic foundations and shake confidence in a network that currently secures around $1.4 trillion in value.

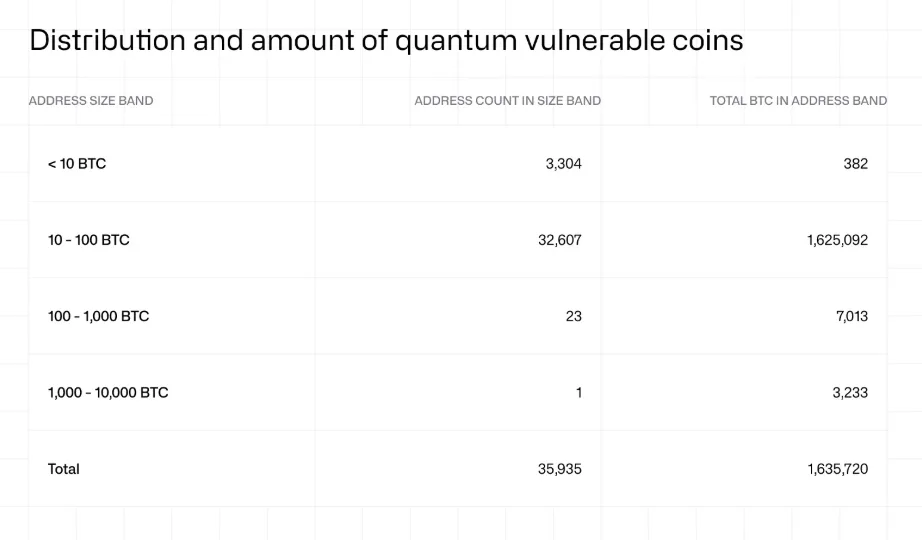

According to CoinShares Bitcoin research lead Christopher Bendiksen, just 10,230 BTC out of roughly 1.63 million Bitcoin analyzed sit in wallet addresses with publicly visible cryptographic keys that could, in theory, be targeted by a sufficiently powerful quantum computer. Bendiksen explained that slightly more than 7,000 BTC are held in wallets containing between 100 and 1,000 Bitcoin, while around 3,230 BTC are stored in addresses holding between 1,000 and 10,000 Bitcoin. At current prices, this amounts to about $719 million, could resemble a routine large trade in today’s market rather than a systemic shock.

(Source: CoinShares)

The vast majority of Bitcoin, approximately 1.62 million BTC in this analysis, are held in wallets containing less than 100 Bitcoin. Bendiksen claimed that even under an extremely optimistic view of technological progress, each of these wallets would take roughly a thousand years to crack using quantum methods.

He also explained that current fears are largely theoretical and stem from well-known quantum algorithms like Shor’s algorithm, which could potentially break elliptic-curve cryptography, and Grover’s algorithm, which could weaken the security of SHA-256 hashing.

Crucially, Bendiksen pointed out that neither of these algorithms could alter Bitcoin’s fixed supply of 21 million coins or bypass proof-of-work, which are core pillars of the network’s design. The Bitcoin considered most at risk are unspent transaction output (UTXO) wallets, many of which date back to the earliest “Satoshi era” and have never been moved.

Some people, including Strategy executive chairman Michael Saylor and Blockstream CEO Adam Back, agree that quantum threats are being overstated and are unlikely to impact Bitcoin for decades. Bendiksen aligns with this perspective by pointing out that a real-world attack would require millions of fault-tolerant qubits — far beyond the roughly 105 qubits achieved by Google’s latest quantum computer, Willow.

Not everyone agrees. Capriole Investments founder Charles Edwards described quantum computing as a potential existential threat, and argued that Bitcoin should implement upgrades sooner rather than later.