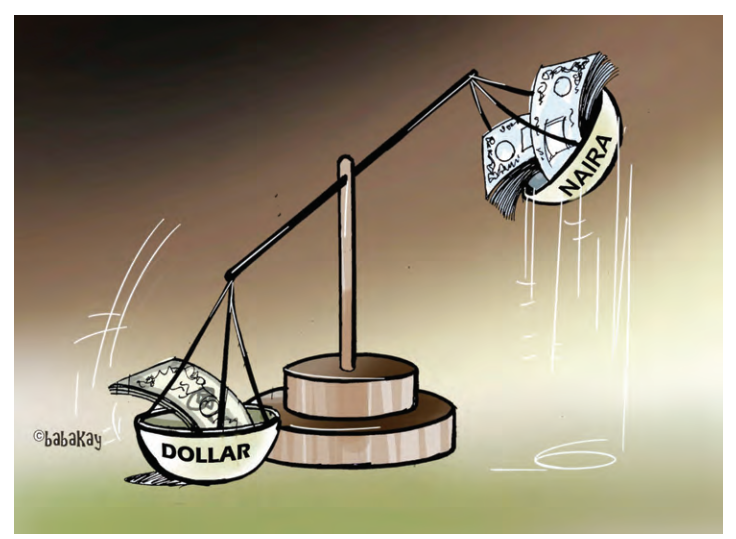

On Wednesday, Vice President Kashim Shettima came short of raining curses on social media users who celebrated the depreciation of the naira that was exchanged for over N1, 400 per dollar. Instead of celebrating what should unite Nigerians against economic forces pulling down the naira, the vice president deplored the act of predicting darker days ahead, as some predicted that a dollar may exchange for N2,000 before the end of next month.

Only the unacquainted would disagree that the present inflation has led to rising prices of goods and services. Burdened by the sense of urgency in tackling the free fall of the naira in the foreign exchange market that saw the dollar exchanged for N1.400, the Central Bank of Nigeria (CBN) has virtually thrown everything in the fire to save what is left of the local currency. Apart from the directive by President Bola Ahmed Tinubu to the apex bank to take over proceeds of crude oil sales from the Nigerian National Petroleum Company Limited (NNPCL), banks were ordered to sell all excess dollars in their possession on or before Thursday 1st February, 2024.

Confronting fraud headlong

For those conversant with financial operations in Nigeria, the dream of rescuing the naira from the claws of foreign exchange operators – some say manipulators, and ridding it of undesirable elements may turn out to be a long and tortuous journey. At the roots of the current crumbling naira is the persistent corruption that is a product of insider abuse. Some banks manipulate the financial system to not only compromise standards, but work against the economic interests of the country. Despite the establishment of relevant regulatory bodies to rein in unhealthy practices by forex operators, glaring incapacity by regulators has led to sustained bleeding of the economy; an act aided by light-fingered technocrats and politicians in various levers of power.

Financial experts have accused some commercial banks of holding large stock of foreign currencies for profit. Calling on commercial banks to play by the rules, the apex bank warned forex dealers against speculation for the sole purpose of unleashing violability in the forex market. To drive the urgency for stiffer measures against those devoted to the weakening of the naira against the dollar, bureau de change operators defiantly shut down operations, an action that led to the spiking of the dollar exchanged for N1,500 in the black market.

Getting to roots of the crisis

When this week, President Tinubu directed the CBN to take over sales of crude oil from the NNPCL, critics of the government denounced the order, citing that the directive is in contravention of the law establishing the NNPCL. The management of the oil sector has always been opaque as the NNPCL has always exercised absolute control with any form of a regulatory agency to check its books. That is why the oil company was never audited for eight years, and no one was called to question. To simply surrender the nation’s forex earnings to an outfit that is no stranger to controversies amounts to entrenching unwholesomeness in running the economy of our country. Allowing the NNPC, now designated a private outfit that is blessed with an indolent workforce, to continue exercising supremacy over the operations of the oil sector amounts to surrendering the economic sovereignty to an entity whose performance has attracted a cacophony of voices over its performance,

Tinubu’s directive for the CBN to take over crude oil sale is a welcomed development that should be encouraged. Former Vice President Atiku’s opposition to Tinubu’s directive to the CBN is politics taken too far. Allowing the NNPCL to continue in its opaque style of managing oil earnings is a recipe for under-the-table deals that are often associated with the oil sector. The law should not be primarily concerned with defending corporate organisations and placing less emphasis on respect for the rule of law. Oil proceeds remain Nigeria’s massive foreign exchange earner and the NNPCL should not be the only body that sells and declares earnings from oil sales. With the CBN now in charge of the sales, Nigerians can now hope for transparency.

Tackling source of the problem

Devoid of disputation, some commercial banks are behind the current travail of the forex market. If anything, the government should continue to pay close attention to the unethical practices being perpetrated and perpetuated by some financial institutions with the sole purpose of reprimanding offenders. Bureau de change operators are mere extensions of rogue elements in both the apex and commercial banks. If only one or two banks are made scapegoats in the coming days, other fraudulent financial organisations may learn a lesson to avoid being caught in the act. To dissuade behind-the-scenes maneuvers, the current administration should come hard on some of the commercial banks engaged in hoarding over hundreds of billions of dollars for profitability.

The Tinubu administration has started a war that would either make or mar the economy of our nation. What is needed now is the cooperation and collaboration of all citizens and corporate bodies. What is at stake is not only the health of Nigeria’s financial sector, but the survival of the country. For the forex market to be rid of financial banditry compromising its operations, the government must cleanse the system by ensuring that banks follow the rules of the game. Anything short of this is an open invitation to an unimaginable crisis of frightening proportion.